Advertisements

Advertisements

Question

Explain the concept of Investment Multiplier using a diagram.

Solution

- Once made, an investment has the potential to generate revenue in multiples of the initial amount. An investment multiplier is thus the ratio of income growth to investment growth.

- Assume the government of the country spends ₹100 crores on road construction, i.e. ΔI = ₹100. The first effect is that it raises the income of workers by millions of rupees.

- Assume MPC = 0.75, which is 0.75 times 100 on consumer goods. Producers of these commodities will get an additional 75 crores. This additional money, i.e. 0.75 × 75 = 56.25 crores, will be spent on products.

- This process will go on till the change in income becomes equal to multiple times changes in investment.

| Round | AI | AY | AC |

| I | 100 | 100 | 75 |

| II | 75 | 56.25 | |

| III | 56.25 | 42.18 | |

| Total | 400 | 300 |

Additional income = ₹ 400

`K = (ΔY)/(ΔI)`

`400/100 = 4`

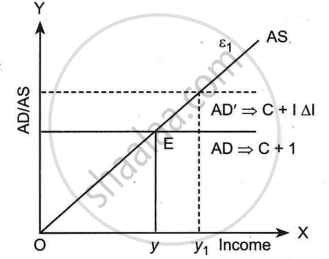

The working of the multiplier can be shown with the help of the following diagram:

In the graph, AD ⇒ C + I is the Aggregate demand curve, intersecting with the AS curve at point E.

Due to the additional investment (ΔI), the AD curve shifts to AD2 ⇒ C + I + AI, giving a new equilibrium level of income OY1, showing the effect of the multiplier.

APPEARS IN

RELATED QUESTIONS

What is the relation between marginal propensity to consume and multiplier?

Calculate the marginal propensity to consume if the value of multiplier.

If MPC = 0, the value of the multiplier is: (Choose the correct alternative)

a. 0

b. 1

c. Between 0 and 1

d. Infinity

Explain the relationship between investment multiplier and marginal propensity to consume.

Answer the following question.

Find the value of additional investment made by the government, when MPC 05 and the increase in income (ΔY) = ₹ 1000.

If in an economy :

Change in initial Investments (∆I) = ₹ 500 crores

Marginal Propensity to Save (MPS) = 0.2

Keynesian multiplier establishes a relationship between ______

Keynes derived Investment Multiplier from Kahn’s ______

Discuss the mechanism of investment multiplier with the help of a numerical.

The formula of investment multiplier in terms of MPS is (1)

Which of the following statements is true?

For a hypothetical economy, assuming there is an increase in the Marginal Propensity to Consume (MPC) from 80% to 90% and change in investment to be ₹ 1000 crore.

Using the concept of investment multiplier, calculate the increase in income due to change in Marginal Propensity to Consume.

For a hypothetical economy, assuming there is an increase in the Marginal Propensity to Consume from 80% to 90% and change in investment to be ₹ 2000 crore.

Using the concept of investment multiplier, calculate the increase in income due to change in Marginal Propensity to Consume.

If a linear consumption curve takes a parallel shift downwards, the value of investment multiplier will ______.

Mention any one difference between Induced investment and Autonomous investment.