Advertisements

Advertisements

प्रश्न

Explain national income determination through the two alternative approaches. Use Diagram.

उत्तर

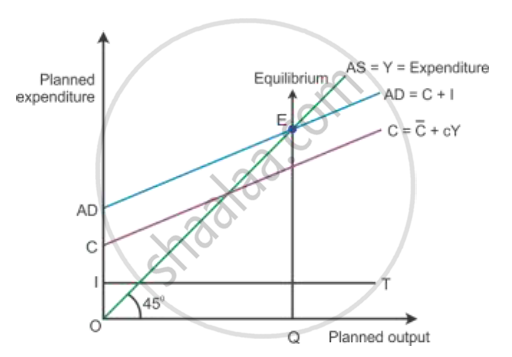

Aggregate demand and aggregate supply approach

The equilibrium level of income is attained only when the aggregate demand is equal to the aggregate supply. It is the level of output where producers plan to produce an amount of good which is equal to consumers’ plans to purchase the amount of good. Thus, equilibrium is struck where the planned output (AS) is equal to the planned expenditure (AD) during a period of time

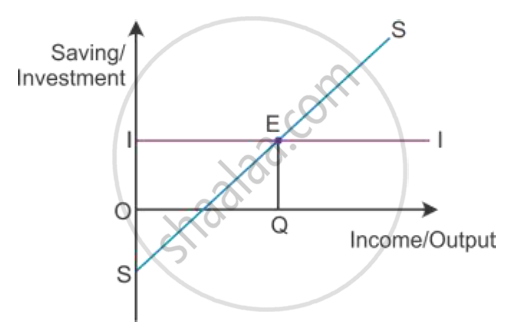

Saving and Investment Approach

The equilibrium is determined at a point where the saving and investment are equal to each other, i.e. leakages = injections

In the diagram, SS shows the saving curve and II shows the investment curve, and the investment curve shows autonomous investment. Savings is equal to investment at Point E, where the saving curve SS and the investment curve intersect each other.

APPEARS IN

संबंधित प्रश्न

Giving reason explain how should the following be treated in the estimation of national income:

Expenditure by a firm on payment of fees to a chartered accountant

Calculation National Income and Personal Disposable Income:

| (Rs crores) | ||

| 1 | Personal tax | 80 |

| 2 | Private final consumption expenditure | 600 |

| 3 | Undistributed profits | 30 |

| 4 | Private income | 650 |

| 5 | Government final consumption expenditure | 100 |

| 6 | Corporate tax | 50 |

| 7 | Net domestic fixed capital formation | 70 |

| 8 | Net indirect tax | 60 |

| 9 | Depreciation | 14 |

| 10 | Change in stocks | (-)10 |

| 11 | Net imports | 20 |

| 12 | Net factor income to abroad | 10 |

Calculation National Income and Personal Disposable Income:

| (Rs crores) | ||

| 1 | Rent | 100 |

| 2 | Net current transfers to rest of the world | 30 |

| 3 | Social security contributions by employers | 47 |

| 4 | Mixed income | 600 |

| 5 | Gross domestic capital formation | 140 |

| 6 | Royalty | 20 |

| 7 | Interest | 110 |

| 8 | Compensation of employees | 500 |

| 9 | Net domestic capital formation | 120 |

| 10 | Net factor income from abroad | (-)10 |

| 11 | Net indirect tax | 150 |

| 12 | Profit | 200 |

Giving reason explain how the following should be treated in the estimation of national income:

Payment of interest by an individual to a bank

Giving reasons explain how should the following be treated in the estimation of national income:

Purchase of machinery by a factory for own use

How should the following be treated in estimating the national income of a country? You must give the reason for your answer

Expenditure on providing police services by the government

C = 50 + 0.5 Y is the Consumption Function where C is consumption expenditure and Y is National Income and Investment expenditure is 2000 is an economy. Calculate

(i) Equilibrium level of National Income.

(ii) Consumption expenditure at equilibrium level of national income.

State whether the following statement is true or false.

Investment made by the government is autonomous investment.

Define of Explain the following concept.

Net earnings from foreign trade

Answer in brief.

Give different definitions of National Income.

Distinguish between Illegal income and Transfer income.

State with reason whether you agree or disagree with the following statement:

Gross National product and Gross Domestic product are same concepts.

Write short note on:

Personal disposable income

Find the odd word

Concepts of national income -

Study the following table, figure, passage and answer the question given below it.

| Components of GNP for the year 2018 |

In crores |

| Consumption | 200 |

| Investment | 300 |

| Govt.Expenditure | 400 |

| Net export | - 100 |

| Net receipts | - 50 |

| Depreciation | 100 |

A. Complete the formula

GNP = C + `square` + G + (X - M) + `square` (1m)

B. Calculate Gross National Product & Net National Product from the above data. (3m)

Net National product at factor cost is also known as

Trace the relationship between GNP and NNP.

NNPMP =

GDP MP = Rs.1000 and subsidies = Rs.50, then GDP FC will be ______.