Advertisements

Advertisements

प्रश्न

Fiscal deficit equals :

(a) Interest payments

(b) Borrowings

(c) Interest payments less borrowing

(d) Borrowing less interest payments

उत्तर

The correct option is (b). Fiscal deficit is the excess of total expenditure, i.e. revenue and capital expenditure over total receipts. This measure reflects total borrowings of the government during the financial year.

APPEARS IN

संबंधित प्रश्न

Define revenue

Discuss the issue of deficit reduction.

Answer the following question.

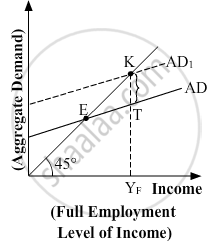

In the given figure, what does the gap 'KT' represent? State any two fiscal measures to correct the situation.

Fiscal deficit = ______.

Assertion (A): Fiscal deficit is measured in terms of borrowings.

Reason (R): External borrowings increases the Fiscal deficit.

When the revenue receipts are less than the revenue expenditures in a government budget, this shortfall is termed as

The difference between fiscal deficit and interest payment is known as ______

Which of the following statements are correct

Statement 1: Fiscal deficits are not necessarily inflationary; though, they are generally regarded as inflationary.

Statement 2: When the government expenditure increases and tax reduces, there is a government deficit and there will be a corresponding increase in the aggregate demand.

______ are the transactions between the residents of two countries that take place due to consideration of profit.

Which of the following transactions are correct about ORT?

How do we get the primary deficit from the fiscal deficit?

If India exports goods worth ₹20 crores and imports goods worth ₹30 crores, it will have a ______

Which of the following points are related to the current alarm?

Which of the following statements is true?

Fiscal deficit equals:

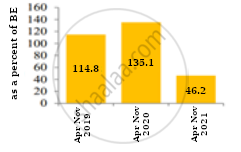

Compare the trends depicted in the figures given below:

| Figure 1: Trends in Fiscal deficit and Primary deficit |

Figure 2: Fiscal deficit as a percent of Budget estimate |

|

|

On the basis of the given information, calculate the value of:

- Fiscal deficit

- Primary deficit

| S.No. | Items | 2021-22 (₹ in crore) |

| (i) | Revenue Receipts | 20 |

| (ii) | Capital Expenditure | 15 |

| (iii) | Revenue Deficit | 10 |

| (iv) | Non-debt creating capital receipts | 50% of revenue receipts |

| (v) | Interest Payments | 4 |

A large amount of fiscal deficit proves to be counter productive. Give any two reasons in support of this statement.