Advertisements

Advertisements

प्रश्न

Revenue receipts in the government's budget:

विकल्प

create liability

reduce liability and create assets

reduce assets

keep liability and assets unaltered

उत्तर

keep liability and assets unaltered

Explanation:

Revenue receipts in the government's budget relate to the income received by the government from various sources, including tax and non-tax revenue. These receipts do not create liabilities because they are not borrowed funds nor do they create assets; rather, they are recorded as an increase in the government's financial resources. As a result, they neither create liabilities nor alter assets directly.

APPEARS IN

संबंधित प्रश्न

Define or Explain.

Plan expenditure

Give reason of Explain the statement

Revenue receipts and Revenue expenditure is known as Revenue Budget.

Write short note on:

Revenue receipts

Write short note on:

Capital expenditure

Answer the following question

What are the main components of budget?

State with reason whether you agree or disagree with the following statement.

Capital budget consists of revenue receipts and revenue expenditure.

The government budget shows the government’s ______.

One of the two components of government budget is ______.

One of the two components of government budget is ______.

One of the other two components of Revenue budget is ______.

One of the two components of Capital budget is ______.

One of the other two components of Capital budget is ______.

|

2019-2020 वास्तविक Actuals |

||

| 1. | Revenue Receipts | 1684059 |

| 2. Tax Revenue (Net Tax Revenue) | 1356902 | |

| 3. Non-Tax Revenue | 327157 | |

| 4. | Capital Receipts | 1002271 |

| 5. Recovery of Loans | 18316 | |

| 6. Others Receipts | 50304 | |

| 7. Borrowings and Other Liabilities | 933651 | |

| 8. | Total Receipts (1 + 4) | 2686330 |

| 9. | Total Expenditure (10 + 13) | 2686330 |

| 10. On Revenue Account | 2350604 | |

The percentage change in the Non-Tax Revenue, between 2019-20 (Actual) and 2020- 21(Budgeted Estimate), taking 2019-20 as base, would be ____________.

______ deals with how consumers or the producers make decisions depending on their given budget.

The excess of government expenditure over government income is termed as ______

Match the following

| A. | It does not create assets for the government | a. | fiscal deficit |

| B. | It results in the creation of assets. | b. | Revenue expenditure |

| C. | It is the excess of total expenditure over total receipts. | c. | Capital expenditure |

Which is a component of the Budget?

On the basis of the below-mentioned information answer the following question:

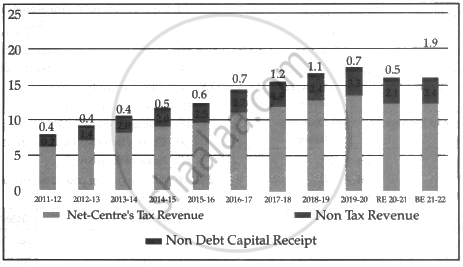

Net Receipt of the Centre (₹ in lakh crore)

The value of non-tax revenue has ______ crores between 2016-17 and 2017-18.