Advertisements

Advertisements

Question

Explain the following objective of government budget:

Reducing income inequalities

Solution

Budgetary policy in reducing inequalities in income:

Fiscal policy implies the income and expenditure policy or the budgetary policy of the government. Income inequality has increased in both advanced and developing economies in recent decades. Evidence from public surveys indicates that widening income inequality has been accompanied by growing public demand for income redistribution. Governments can play a significant role in reducing inequality of income and wealth as well as inequality of opportunity through fiscal policies.

Both tax and spending policies can alter the distribution of income over both short-term and medium-term. For example, progressive income taxes and cash transfers can reduce the inequality of disposable incomes today. Spending on education has an impact on future earnings, and therefore, it could eventually increase the number of individuals earning a higher income.

APPEARS IN

RELATED QUESTIONS

Define money supply

Explain money supply components.

State the two components of M1 measure of Money Supply.

On the basis of government law, the compulsory payment made by the public is known as ______

Which among is the direct tax?

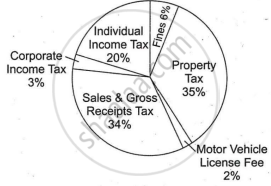

Study the given picture carefully:

| Sources of State and Local Government tax revenues for a financial year |

|

Answer the following questions based on common knowledge and picture:

- Categorise the given items in the picture into tax/non-tax receipts.

- “Government has started spending more on providing free services like education and health to the poor.”

In the light of above statement, explain how the government can use the budgetary policy in reducing ‘inequalities of income’.