Advertisements

Advertisements

Question

Long Answer Question

Explain how financial statements are useful to the various parties who are interested in the affairs of an undertaking?

Solution

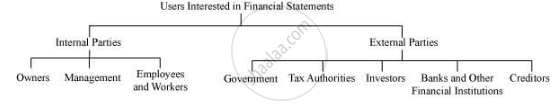

The various parties that are directly or indirectly interested in the financial statements of a company can be categorized into the following two categories:

1. Internal parties

2. External parties

Internal Parties

The following are the various internal accounting users who are directly related to the company.

1. Owner− The owner/s is/are interested in the profit earned or loss incurred during an accounting period. They are interested in assessing the profitability and viability of the capital invested by them in the business.

2. Management− The financial statements help the management in drafting various policies measures, facilitating planning and decision making process. The financial statements also enable management to exercise various cost controlling measures and to remove inefficiencies.

3. Employees and workers− They are interested in the timely payment of wages and salaries, bonus and appropriate increment in their wages and salaries. With the help of the financial statements they can know the amount of profit earned by the company and can demand reasonable hike in their wages and salaries.

External Parties

There are various external users of accounting who need accounting information for decision making, investment planning and to assess the financial position of the business. The various external users are given below.

1. Banks and other financial institutions− Banks provide finance in the form of loans and advances to various businesses. Thus, they need information regarding liquidity, creditworthiness, solvency and profitability to advance loans.

2. Creditors− These are those individuals and organisations to whom a business owes money on account of credit purchases of goods and receiving services; hence, the creditors require information about credit worthiness of the business.

3. Investors and potential investors− They invest or plan to invest in the business. Hence, in order to assess the viability and prospectus of their investment, creditors need information about profitability and solvency of the business.

4. Tax authorities− They need information about sales, revenues, profit and taxable income in order to determine the levy various types of tax on the business.

5. Government− It needs information to determine national income, GDP, industrial growth, etc. The accounting information assist the government in the formulation of various policies measures and to address various economic problems like employment, poverty etc.

6. Researchers− Various research institutes like NGOs and other independent research institutions like CRISIL, stock exchanges, etc. undertake various research projects and the accounting information facilitates their research work.

7. Consumers− Every business tries to build up reputation in the eyes of consumers, which can be created by the supply of better quality products and post-sale services at reasonable and affordable prices. Business that has transparent financial records, assists the customers to know the correct cost of production and accordingly assess the degree of reasonability of the price charged by the business for its products and ,thus, helps in repo building of the business.

8. Public− Public is keenly interested to know the proportion of the profit that the business spends on various public welfare schemes; for example, charitable hospitals, funding schools, etc. This information is also revealed by the profit and loss account and balance sheet of the business.

APPEARS IN

RELATED QUESTIONS

Under which head following revenue items of a non-financial company will be classified or shown:

(i) Sales;

(ii) Revenue from Services Rendered;

(iii) Sale of Scrap;

(iv) Interest Earned on Loans; and

(v) Gain (profit) on Sale of Investments?

Under which head following revenue items of a financial company will be classified or shown:

(i) Gain (Profit) on Sale of Building;

(ii) Revenue from Project Consultancy Rendered;

(iii) Sale of Scrap;

(iv) Interest earned on Loans; and

(v) Gain (Profit) on sale of Investments?

Under which head following revenue items of non-financial company will be classified or shown:

(i) Gain (Profit) on Sale of Fixed Asset;

(ii) Fee Received for Arranging Loans;

(iii) Interest on Loans Given;

(iv) Gain (Profit) on Sale of Investments and

(v) Sale of Miscellaneous Items?

In a company’s balance sheet Assets are shown in the order of ________.

Office building under construction will be shown under ________.

Assets are divide in to ______.

Reserve and surplus are comes in which head ______.

An example of fixed asset is ______.

The assets held by a business which can be converted in the form of cash, without disturbing the normal operations of a business ______.

The return which the company pays on borrowed funds is termed as ______.

The following is(are) the external source(s) of cash.

Carriage Inward is normally debited to _______.

Those liabilities which may or may not arise as they are dependent on happening in future.

Preliminary expenses include ______.