Advertisements

Advertisements

Question

Explain the steps involved in calculating the National income by Income method.

Solution

National Income can be calculated by three methods:

- Product method

- Income method

- Expenditure method

Income method of calculating National Income involves the income generated from all the factors of production in an economy in a given time period.

Following are the steps involved:

STEP I: Identification and classification of producing enterprises.

In this method, all the production units that employ factor inputs are identified i.e.

(a) Primary sector

(b) Secondary sector

(c) Tertiary sector

STEP II: Classification of factor income.

Factor income generated in the production unit are classified into the following categories:

- Compensation of employees: It includes, wages and salary in cash and kind, employers contribution to social security scheme etc.

- Operating surplus: It is the sum of income from property i.e rent, royalty and interest and income from entrepreneurship i.e profits. Profits can be divided into three parts:

- Dividends

- Undistributed profits

- Corporate tax

- Mixed income of self-employed: This is the income of self-employed people that have mixed characteristics of both compensation of employees and operating surplus. Example- fees charged by a doctor, fees charged by a lawyer.

STEP III: Estimation of domestic factor income (NDPfc)·

Factor income paid by each producing unit mentioned above are added to obtain NDPfc' (Domestic income)

NDPfc = Compensation of employees + Operating surplus + Mixed income of self-employed

STEP IV: Estimation of National Income (NNPfc).

To calculate National Income, NFIA (Net factor income from abroad) is added to domestic factor income (NDPfc)·

NNPfc = NDPfc + NFIA

APPEARS IN

RELATED QUESTIONS

Explain non-monetary exchanges as a limitation of using the gross domestic product as an index of the welfare of a country

“Income method” is also known as ______.

State which one of the following is true.

Identify the correctly matched pair of items in Column A to those in Column B:

| Column A | Column B |

| 1. Income Tax | (a) Forced Transfer |

| 2. Services of Housewives | (b) Market Activities |

| 3. Retirement Pension | (c) Taxable for Firm |

| 4. Annual value of goods and services produced. | (d) Income method |

In an economy, C = 300 + 0.5Y and I = ?. 600/- (where C = consumption, Y = income or investment). Computer the Consumption expenditure at equilibrium level of income

Suppose C = 40 + 0.8Y D. T = 50, I = 60, G = 40, X = 90, M = 50 + 0.05Y. Find the net export balance at equilibrium income

Suppose C = 40 + 0.8Y D. T = 50, I = 60, G = 40, X = 90, M = 50 + 0.05Y. What happens to equilibrium income and the net export balance when the government purchases increase from 40 to 50?

How is the interest earned by normal resident treated?

What is the other name for Income Method?

Assertion (A): Profits of chemical industries increased 150%; fishermen income reduced by 70% due to untreated chemical pollutants in water bodies. This is a negative externality.

Reason (R): The profits of chemical industries is causing pollution which is harming the water and inturn leading the fishermen to catch less fish as the biodiversity of the water body is disturbed.

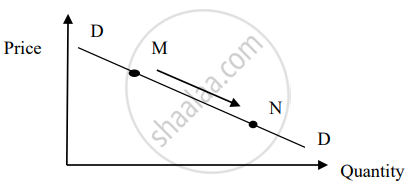

Read the following figure carefully and choose the correct pair from the alternatives given below:

Explain the precautions to be taken while using the income method of measuring national income.

Find the odd word out:

Transfer payments:

Calculate National Income using Income method and Output method.

| PARTICULARS | (₹ crores) | |

| (i) | Value of output | 1200 |

| (ii) | Wages and salaries | 165 |

| (iii) | Rent | 60 |

| (iv) | Subsidies | 15 |

| (v) | Mixed Income of self employed | 180 |

| (vi) | Employer's contribution to social security | 15 |

| (vii) | Value of intermediate consumption | 600 |

| (viii) | Interest | 7 |

| (ix) | Factor income earned from abroad | 15 |

| (x) | Indirect taxes | 90 |

| (xi) | Profits | 23 |

| (xii) | Depreciation | 75 |

| (xiii) | Factor income paid abroad | 30 |

With reference to the diagram shown above, select the reason for the movement from point M to N from the following options.