Advertisements

Advertisements

प्रश्न

Are fiscal deficits inflationary?

उत्तर

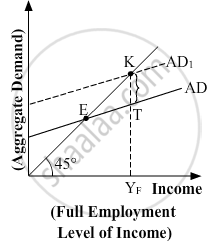

Fiscal deficits are not necessarily inflationary; though, they are generally regarded as inflationary. When the government expenditure increases and tax reduces, there is a government deficit and there will be a corresponding increase in the aggregate demand. However, the firms might not be able to meet the growing demands, forcing the price to rise. Hence fiscal deficits are inflationary in this sense.

But on the other hand, initially if the resources are underutilised (due to insufficient demand) and output is below full employment level, then with the increase in government expenditure, more factor resources will be employed to cater to the increasing demand without exerting much pressure on price to rise. In this situation, a high fiscal deficit is accompanied by high demand, greater output level and lesser inflationary situation. Hence, whether the fiscal deficits are inflationary or not depends on how close is the original output level to the full employment level.

APPEARS IN

संबंधित प्रश्न

Define fiscal deficit

Suppose marginal propensity to consume is 0.75 and there is a 20 per cent proportional income tax. Find the change in equilibrium income for the following (a) Government purchases increase by 20 (b) Transfers decrease by 20.

Explain the relation between government deficit and government debt.

Answer the following question.

In the given figure, what does the gap 'KT' represent? State any two fiscal measures to correct the situation.

Classify the following statement into positive economic or normative economic, with suitable reason:

Government should try to control the rising fiscal deficit.

Regressive tax is that which is ______.

The primary deficit in a government budget is ______.

When the revenue receipts are less than the revenue expenditures in a government budget, this shortfall is termed as

What is relation between government deficit and government debt?

Which of the following transactions are correct about ORT?

How do we get the primary deficit from the fiscal deficit?

If India exports goods worth ₹20 crores and imports goods worth ₹30 crores, it will have a ______

Identify the correctly matched pair of the items in Column A to those in Column B:

| Column A | Column B | ||

| 1 | Fiscal Deficit | (a) | Other than interest payments |

| 2 | Primary Deficit | (b) | Borrowings less interest payments |

| 3 | Revenue Deficit | (c) | Borrowings |

| 4 | Tax Deficit | (d) | Borrowings in government budget |

Identify which of the following statements is true.

The shape of average revenue curve in monopoly is ______

On the basis of the given information, calculate the value of:

- Fiscal deficit

- Primary deficit

| S.No. | Items | 2021-22 (₹ in crore) |

| (i) | Revenue Receipts | 20 |

| (ii) | Capital Expenditure | 15 |

| (iii) | Revenue Deficit | 10 |

| (iv) | Non-debt creating capital receipts | 50% of revenue receipts |

| (v) | Interest Payments | 4 |