Advertisements

Advertisements

प्रश्न

Does public debt impose a burden? Explain.

उत्तर

Government debt or public debt refers to the amount or money that a central government owes. This amount may be borrowings of the government from banks, public financial institutions and from other external and internal sources. Public debt definitely imposes a burden on the economy as a whole, which is described through the following points.

1. Adverse effect on productivity and investment :-

A government may impose taxes or get money printed to repay the debt. This however reduces the peoples’ ability to work, save and invest, thus hampering the development of a country.

2. Burden on younger generations :-

The government transfers the burden of reduced consumption on future generations. Higher government borrowings in the present leads to higher taxes levied in future in order to repay the past obligations. The government imposes taxes on the younger generations, lowering their consumption, savings and investments. Hence, higher public debt has negative effect on the welfare of the younger generations.

3. Lowers the private investment :-

The government attracts more investment by raising rates of interests on bonds and securities. As a result, a major part of savings of citizens goes in the hands of the government, thus crowding out private investments.

4. Leads to the drain of National wealth :-

The wealth of the country is drained out at the time of repaying loans taken from foreign countries and institutions.

APPEARS IN

संबंधित प्रश्न

Distinguish between revenue deficit and fiscal deficit.

Suppose marginal propensity to consume is 0.75 and there is a 20 per cent proportional income tax. Find the change in equilibrium income for the following (a) Government purchases increase by 20 (b) Transfers decrease by 20.

Discuss the issue of deficit reduction.

Answer the following question.

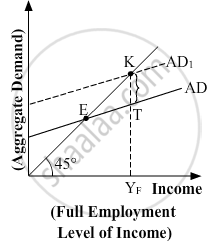

In the given figure, what does the gap 'KT' represent? State any two fiscal measures to correct the situation.

Classify the following statement into positive economic or normative economic, with suitable reason:

Government should try to control the rising fiscal deficit.

Suppose you are a member of the "Advisory Committee to the Finance Minister of India". The Finance Minister is concerned about the rising Revenue Deficit in the budget.

Suggest anyone measure to control the rising Revenue Deficit of the government.

The primary deficit in a government budget is ______.

A fiscal deficit is equal to borrowings. It is ______

When the revenue receipts are less than the revenue expenditures in a government budget, this shortfall is termed as

______ in the budget is an important measure of deficit.

Which of the following transactions are correct about ORT?

How do we get the primary deficit from the fiscal deficit?

If India exports goods worth ₹20 crores and imports goods worth ₹30 crores, it will have a ______

Identify the correctly matched pair of the items in Column A to those in Column B:

| Column A | Column B | ||

| 1 | Fiscal Deficit | (a) | Other than interest payments |

| 2 | Primary Deficit | (b) | Borrowings less interest payments |

| 3 | Revenue Deficit | (c) | Borrowings |

| 4 | Tax Deficit | (d) | Borrowings in government budget |

Fiscal deficit equals:

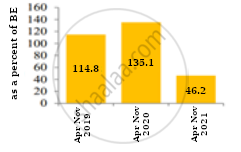

Compare the trends depicted in the figures given below:

| Figure 1: Trends in Fiscal deficit and Primary deficit |

Figure 2: Fiscal deficit as a percent of Budget estimate |

|

|

How good is the system of G.S.T as compared to the old tax system?