Advertisements

Advertisements

प्रश्न

Give reason or explain the following statement:

National income at factor cost includes subsidy.

उत्तर

Factor costs are the actual payments made to the factors of production for rendering their service in the course of production. In case subsidy is provided for the same, its value must also be included to get the correct value of factor cost.

APPEARS IN

संबंधित प्रश्न

National income

Total Cost and Total Revenue.

Explain the various methods of measuring national income.

In order to avoid double counting, value added approach is used.

Unpaid services are not included in national income.

Explain various types of investment expenditure.

Explain in detail ‘saving function’ with schedule and diagram.

Find national income and private income:

(Rs crore)

(i) Wages and salaries 1,000

(ii) Net current transfer to abroad 20

(iii) Net factor income paid to abroad 10

(iv) Profit 400

(v) National debt interest 120

(vi) Social security contributions by employers 100

(vii) Current transfers from government 60

(viii) National income accruing to government 150

(ix) Rent 200

(x) Interest 300

(xi) Royalty 50

Calculate National Income from the following data:

| S.No. | Particulars | Rs.in crores |

| (i) | Private final consumption expenditure | 900 |

| (ii) | Profit | 100 |

| (iii) | Government final consumption expenditure | 400 |

| (iv) | Net indirect taxes | 100 |

| (v) | Gross domestic capital formation | 250 |

| (vi) | Change in stock | 50 |

| (vii) | Net factor income from abroad | (-)40 |

| (viii) | Consumption of fixed capital | 20 |

| (ix) | Net imports | 30 |

Find national income from the following:

Autonomous consumption = Rs100

Marginal propensity to consume = 0.80

Investment = Rs 50

Explain the impact of rise in exchange rate on national income.

Explain the precautions that should be taken while estimating national income by expenditure method.

Giving reason explain how should the following be treated in the estimation of national income:

Payment of corporate tax by a firm

Giving reason explain how should the following be treated in the estimation of national income:

Purchase of refrigerator by a firm for own use

Giving reason explain how the following should be treated in the estimation of national income:

Payment of interest by a firm to a bank

Giving reason explain how the following should be treated in the estimation of national income:

Payment of interest by a bank to an individual

Giving reason explain how the following should be treated in the estimation of national income:

Payment of interest by an individual to a bank

Calculate the 'National Income' and 'Private Income' :

| (Rs in crores) | ||

| 1 | Rent | 200 |

| 2 | Net factor income to abroad | 10 |

| 3 | National debt interest | 15 |

| 4 | Wages and salaries | 700 |

| 5 | Current transfers from government | 10 |

| 6 | Undistributed profit | 20 |

| 7 | Corporation tax | 30 |

| 8 | Interest | 150 |

| 9 | Social security contributions by employers | 100 |

| 10 | Net domestic product accruing to government | 250 |

| 11 | Net current transfers to rest of the world | 5 |

| 12 | Dividends | 50 |

Calculate 'Net National Product at Market Price' and 'Personal Income'.

| (Rs crore) | ||

| (i) | Transfer payments by government | 7 |

| (ii) | Government final consumption expenditure | 50 |

| (iii) | Net imports | -10 |

| (iv) | Net domestic fixed capital formation | 60 |

| (v) | Private final consumption expenditure | 300 |

| (vi) | Private income | 280 |

| (vii) | Net factor income to abroad | -5 |

| (viii) | Closing stock | 8 |

| (ix) | Opening stock | 8 |

| (x) | Depreciation | 12 |

| (xi) | Corporate tax | 60 |

| Xii | Retained earnings of corporatio | 20 |

Giving reasons explain how should the following be treated in the estimation of national income:

Purchase of machinery by a factory for own use

Giving reasons explain how should the following be treated in the estimation of national income:

Purchase of uniforms for nurses by a hospital

Calculate investment expenditure from the following data about an economy which is in equilibrium:

National income = 1500

Autonomous consumption expenditure = 300

Investment expenditure = 300

Calculate national income and gross national disposable income from the following:

| (Rs Arab) | ||

| 1 | Net current transfers to abroad | 5 |

| 2 | Government final consumption expenditure | 100 |

| 3 | Net indirect tax | 80 |

| 4 | Private final consumption expenditure | 300 |

| 5 | Consumption of fixed capital | 20 |

| 6 | Gross domestic fixed capital formation | 50 |

| 7 | Net imports | (-)10 |

| 8 | Closing stock | 25 |

| 9 | Opening stock | 25 |

| 10 | Net factor income to abroad | 10 |

How should the following be treated in estimating the national income of a country? You must give the reason for your answer

Expenditure on providing police services by the government

Calculate 'National Income' and 'Net National Disposable Income' from the following

| (Rs in Arab) | ||

| 1 | Net change in stock | 50 |

| 2 | Government final consumption expenditure | 100 |

| 3 | Net current transfers to abroad | 30 |

| 4 | Gross domestic fixed capital formation | 200 |

| 5 | Private final consumption expenditure | 500 |

| 6 | Net imports | 40 |

| 7 | Depreciation | 70 |

| 8 | Net factor income to abroad | (-)10 |

| 9 | Net indirect tax | 120 |

| 10 | Net capital transfers to abroad | 25 |

How should the following be treated while estimating national income? You must give the reason in support of your answer.

Bonus paid to employees

How should the following be treated while estimating national income? You must give the reason in support of your answer.

Purchase of taxi by a taxi driver.

Give reasons or explain the following

The propensity to save depends upon the level of income.

In an economy, S = −100 + 0.6 Y is the saving function, where S is Saving and Y is National Income. If investment expenditure is 1,100, calculate:

(1) Equilibrium level of National Income

(2) Consumption expenditure at equilibrium level of National Income.

C = 50 + 0.5 Y is the Consumption Function where C is consumption expenditure and Y is National Income and Investment expenditure is 2000 is an economy. Calculate

(i) Equilibrium level of National Income.

(ii) Consumption expenditure at equilibrium level of national income.

Distinguish between the following :

Output method and Income method of measuring national income.

Define or explain the following concept.

Disposable income.

State whether the following statement is true or false.

Investment made by the government is autonomous investment.

State whether the following statements are TRUE or FALSE:

Saving increases with increase in income.

Give reasons or explain the following statement:

The concept of national income has an important place in economic development.

Give reasons or explain the following statements:

The net national income is less than gross national income.

Answer the following question:

What is double counting of national income?

Answer the following question:

What are the features of national income?

Answer the following question:

Explain the concept of Gross domestic product at market prices.

Answer the following question:

State the precautions while using expenditure method to measure national income.

Answer the following question:

Explain the income method of measuring national income.

State with reason whether you agree or disagree with the following statement:

Many precautions are to be taken while estimating national income by income method.

State with reason whether you agree or disagree with the following statement:

Gross National product and Gross Domestic product are same concepts.

State with reason whether you agree or disagree with the following statement:

The money value of intermediate goods is not included in the estimation of national income.

Answer in detail:

Explain the Output method of measuring National income.

Distinguish between:

Gross national product and Gross domestic product.

Distinguish between:

Output method of measuring national income and Income method of measuring national income.

Distinguish between:

Gross National Product and Net National Product

Distinguish between:

National income at market prices and national income at factor cost

Write short note on:

Value added approach

Write short note on:

Personal disposable income

Give reason or explain the following statement:

Income from second hand sale of goods is excluded from national income.

Give reason or explain the following statement:

National income estimates are accurate in India.

Give reason or explain the following statement:

Old age pension is transfer income.

State whether the following statement is true or false.

National income is computed every year.

State whether the following statement is true or false.

GDP includes net income from abroad.

State whether the following statement is true or false.

Services of housewives are included in national income.

Fill in the blank with appropriate alternatives given below

Paper purchased by a publisher is __________.

Distinguish between the following.

Personal income and Disposable income

Define the following:

Income from property and entrepreneurship

Complete the following statement.

NNP is obtained by ______.

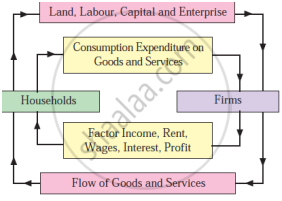

- Explain the concept of product (real flow) with the help of above diagram. (2m)

- Explain the concept of Money flow with the help of above diagram. (2m)

Per capita income is obtained by dividing the National income by the ______.

GNP =______ + Net factor income from abroad.

NNP stands for______.

The average income of the country is______.

What is the difference between NNP and NDP?

Trace the relationship between GNP and NNP.

Define GDP deflator.

Differentiate between personal and disposable income.

Explain briefly NNP at factor cost.

Nominal GNP is same as ____________.

Real GNP is same as ______.

NNPMP =

NNPFC =

Accounting of National Income at constant prices is known as ____________.

GDP MP = Rs.1000 and subsidies = Rs.50, then GDP FC will be ______.

Which one is true?

NNPMP =?

Which of the following is correct?

If economic subsidies are added to and Indirect taxes are substracted from the national income at market prices, then it will be equal to ______.

Total national income divided by total population is known as:

If factor cost is greater than marker price, it means that:

Identify and explain the following concept.

Shobha collected data regarding the money value of all final goods and services produced in the country for the financial year 2019-20.

How should the following be treated in estimating National Income of a Country? Give valid reasons.

Profit earned by Foreign Banks in India.