Advertisements

Advertisements

प्रश्न

Answer the following question.

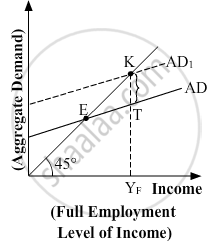

In the given figure, what does the gap 'KT' represent? State any two fiscal measures to correct the situation.

उत्तर

The gap 'KT' represents the inflationary gap. This is the situation of excess demand.

Fiscal policy refers to the policy that is undertaken by the government to influence the economy through the process of its expenditure and taxation.

The fiscal measures to correct the excess demand are given as follows:

- Government Expenditure: The Government of a country incurs various types of expenditure to enhance the welfare of the people and also to facilitate economic growth and development.

In case of excess demand, the government cuts down its expenditures in the form of disinvestment. This lowers the level of economic activity, which in turn, reduces the level of employment, thereby reducing the income level. This subsequently reduces the aggregate demand, thus, the situation of excess demand gets corrected. - Public Borrowings: Through the measure of public borrowings, the government affects the liquidity (cash balances) held by the public. It is because of the excess liquidity, the people demand more and vice-versa. Therefore, the government affects the liquidity balances with the help of public borrowings.

In the case of excess demand, the government raises public borrowings, which reduces the liquidity balances with the public. A reduction in the liquidity lowers the purchasing power of the people, which in turn, lowers the aggregate demand.

संबंधित प्रश्न

Distinguish between revenue deficit and fiscal deficit.

Define revenue

Give the relationship between the revenue deficit and the fiscal deficit.

Consider an economy described by the following functions:- C = 20 + 0.80Y, I = 30, G = 50, TR = 100 (a) Find the equilibrium level of income and the autonomous expenditure multiplier in the model. (b) If government expenditure increases by 30, what is the impact on equilibrium income? (c) If a lump-sum tax of 30 is added to pay for the increase in government purchases, how will equilibrium income change?

Consider an economy described by the following functions:- C = 20 + 0.80Y, I = 30, G = 50, TR = 100, calculate the effect on output of a 10 per cent increase in transfers, and a 10 per cent increase in lump-sum taxes. Compare the effects of the two.

We suppose that C = 70 + 0.70Y D, I = 90, G = 100, T = 0.10Y (a) Find the equilibrium income. (b) What are tax revenues at equilibrium Income? Does the government have a balanced budget?

Are fiscal deficits inflationary?

What do you understand by G.S.T?

Classify the following statement into positive economic or normative economic, with suitable reason:

Government should try to control the rising fiscal deficit.

| S. No. | Content | Rs (in crores) |

| 1. | Revenue Expenditure | 100 |

| 2. | Capital Receipts | 40 |

| 3. | Net Borrowings | 38 |

| 4. | Net Interest Payments | 27 |

| 5. | Tax Revenue | 50 |

| 6. | Non-tax Revenue | 15 |

Which of the following is the formula for revenue deficit?

Which of the following factors necessitated the need for economic reforms?

______ in the budget is an important measure of deficit.

The difference between fiscal deficit and interest payment is known as ______

What is relation between government deficit and government debt?

If India exports goods worth ₹20 crores and imports goods worth ₹30 crores, it will have a ______

Which of the following statements is true?

The shape of average revenue curve in monopoly is ______

How good is the system of G.S.T as compared to the old tax system?

A large amount of fiscal deficit proves to be counter productive. Give any two reasons in support of this statement.