Advertisements

Advertisements

प्रश्न

We suppose that C = 70 + 0.70Y D, I = 90, G = 100, T = 0.10Y (a) Find the equilibrium income. (b) What are tax revenues at equilibrium Income? Does the government have a balanced budget?

उत्तर

(a) C = 70 + 0.70 YD

I = 90

G = 100

T = 0.10Y

Y = C + I +G

Y = 70 + 0.70Y + 90 + 100

Y = 70 + 0.70YD + 190

Y = 70 + 0.70 (Y − T) + 190

Y = 70 + 0.70Y − 0.70 × 0.10 Y + 190

Y = 70 + 0.70Y − 0.07Y + 190

Y = 70 + 0.63Y + 190

Y = 260 + 0.63Y

Y − 0.634 = 260

0.37Y = 260

`Y = 260/0.37`

Y = 702.7

(b) T = 0.10Y

= 0.10 × 702.7

= 70.27

Government expenditure = 100

Tax revenue = 70.27

As, G > T, Government has a deficit budget, not a balanced budget.

APPEARS IN

संबंधित प्रश्न

Fiscal deficit equals :

(a) Interest payments

(b) Borrowings

(c) Interest payments less borrowing

(d) Borrowing less interest payments

‘The fiscal deficit gives the borrowing requirement of the government’. Elucidate.

Give the relationship between the revenue deficit and the fiscal deficit.

Suppose that for a particular economy, investment is equal to 200, government purchases are 150, net taxes (that is lump-sum taxes minus transfers) is 100 and consumption is given by C = 100 + 0.75Y (a) What is the level of equilibrium income? (b) Calculate the value of the government expenditure multiplier and the tax multiplier. (c) If government expenditure increases by 200, find the change in equilibrium income.

Consider an economy described by the following functions:- C = 20 + 0.80Y, I = 30, G = 50, TR = 100 (a) Find the equilibrium level of income and the autonomous expenditure multiplier in the model. (b) If government expenditure increases by 30, what is the impact on equilibrium income? (c) If a lump-sum tax of 30 is added to pay for the increase in government purchases, how will equilibrium income change?

Consider an economy described by the following functions:- C = 20 + 0.80Y, I = 30, G = 50, TR = 100, calculate the effect on output of a 10 per cent increase in transfers, and a 10 per cent increase in lump-sum taxes. Compare the effects of the two.

Explain why the tax multiplier is smaller in absolute value than the government expenditure multiplier.

Does public debt impose a burden? Explain.

Are fiscal deficits inflationary?

Answer the following question.

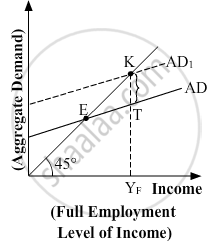

In the given figure, what does the gap 'KT' represent? State any two fiscal measures to correct the situation.

Fiscal deficit = ______.

The primary deficit in a government budget is ______.

______ in the budget is an important measure of deficit.

What is relation between government deficit and government debt?

______ are the transactions between the residents of two countries that take place due to consideration of profit.

If India exports goods worth ₹20 crores and imports goods worth ₹30 crores, it will have a ______

Primary deficit is borrowing requirements of government for making:

Fiscal deficit equals: