Advertisements

Advertisements

Question

Define ‘Market-supply’. What is the effect on the supply of a good when Government imposes a tax on the production of that good? Explain.

Solution

Market supply refers to the total of quantities supplied by all the firms in the market at different price levels.

If, government imposes a tax on the production of a good then, this implies that the cost of production rises. Consequently, the firm will supply lesser units of output. The diagrammatic presentation of the effect on the supply of a good when government imposes a tax on the production of that good is as follows.

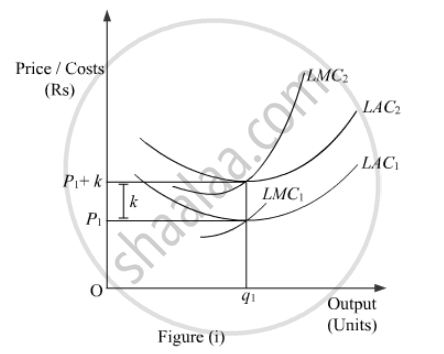

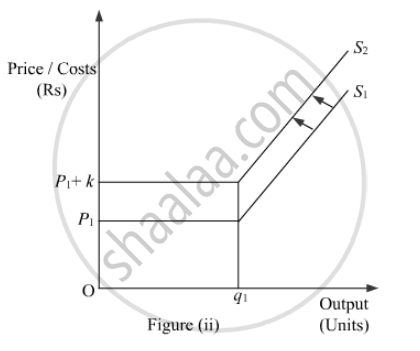

In the diagram, LAC1 and LMC1 are the long run average cost curve and long run marginal cost curve respectively. In the lower panel we represent the supply curve which is the rising part of the LMC. Suppose, initially the firm faces price equal to OP1. Now, if the government imposes a unit tax of Rs ‘k’ per unit of output, then this will raise the cost of production as the firm need to pay an extra amount of Rs k on each unit of the output supplied. Consequently, the cost curves will shift leftwards (upwards) to LMC2 and LAC2. The magnitude of the shift in the cost curves is equal to Rs k. Now, as the supply curve is a rising part of LMC, so the supply curve in the figure (ii) will also shift leftward upwards from S1 to S2. That is, the firm will now supply lesser units of output due to imposition of tax.

APPEARS IN

RELATED QUESTIONS

Price discrimination

Define market supply.

Explain the factor Input prices that can cause a change in supply.

Explain how input prices are a determinant of supply of a good by a firm.

Give reasons or Explain the following statements. (Any Three)

Agricultural goods are exceptions to the law of supply.

Write Explanatory answer. (Any Two )

What do you mean by aggregate supply? Explain deteminants of aggregate supply?

Give reasons or explain the following statement:

Supply cannot exceed stock.

State with reasons, whether you Agree or Disagree with the following statements.:

Market supply depends upon price only.

State Whether the following statements are TRUE or FALSE:

Due to the use of modern production technique supply will decrease.

Choose the correct answer :

In the long term supply becomes _________.

Give reasons or explain the following statement:

Due to speedy transport supply increases.

Define or explain the following concept:

Marginal Cost

Write short note on the following:

Percentage method.

Answer the following question:

Explain the concept of Total Cost, Average Cost and Marginal Cost.