Advertisements

Advertisements

Question

Fill in the blank with appropriate alternatives given below

Paper purchased by a publisher is __________.

Options

intermediate good

final good

consumer good

service

Solution

Paper purchased by a publisher is intermediate good.

Explanation:

Intermediate goods are the goods which are used as a raw material in the production of final goods Accordingly, paper purchased by a publisher is an intermediate good. This is because the publisher would then further use the paper for the books he will publish.

APPEARS IN

RELATED QUESTIONS

National income

Total Cost and Total Revenue.

Distinguish between Gross National Product and Net National Product.

Unpaid services are not included in national income.

Explain various types of investment expenditure.

C = 100 + 0.4 Y is the Consumption Function of an economy where C is Consumption Expenditure and Y is National Income. Investment expenditure is 1.100. Calculate

(i) Equilibrium level of National Income.

(ii) Consumption expenditure at equilibrium level of national income.

Calculate National Income from the following data:

| S.No. | Particulars | Rs.in crores |

| (i) | Private final consumption expenditure | 900 |

| (ii) | Profit | 100 |

| (iii) | Government final consumption expenditure | 400 |

| (iv) | Net indirect taxes | 100 |

| (v) | Gross domestic capital formation | 250 |

| (vi) | Change in stock | 50 |

| (vii) | Net factor income from abroad | (-)40 |

| (viii) | Consumption of fixed capital | 20 |

| (ix) | Net imports | 30 |

Find national income from the following:

Autonomous consumption = Rs100

Marginal propensity to consume = 0.80

Investment = Rs 50

Giving reason explain how should the following be treated in estimating national income:

i. Expenditure on fertilizers by a farmer.

ii. Purchase of tractor by a farmer.

If real income is Rs 400 and price index is 105, calculate nominal income.

Which of the following affects national income? (Choose the correct alternative)

(a) Goods and Service tax

(b) Corporation tax

(c) Subsidies

(d) None of the above

Other things remaining unchanged, when in a country the price of foreign currency rises, national income is: (choose the correct alternative)

a. Likely to rise

b. Likely to fall

c. Likely to rise and fall both

d. Not affected

Giving reason explain how should the following be treated in the estimation of national income:

Expenditure by a firm on payment of fees to a chartered accountant

Giving reason explain how should the following be treated in the estimation of national income:

Payment of corporate tax by a firm

Giving reason explain how should the following be treated in the estimation of national income:

Purchase of refrigerator by a firm for own use

Calculation National Income and Personal Disposable Income:

| (Rs crores) | ||

| 1 | Personal tax | 80 |

| 2 | Private final consumption expenditure | 600 |

| 3 | Undistributed profits | 30 |

| 4 | Private income | 650 |

| 5 | Government final consumption expenditure | 100 |

| 6 | Corporate tax | 50 |

| 7 | Net domestic fixed capital formation | 70 |

| 8 | Net indirect tax | 60 |

| 9 | Depreciation | 14 |

| 10 | Change in stocks | (-)10 |

| 11 | Net imports | 20 |

| 12 | Net factor income to abroad | 10 |

Calculation National Income and Personal Disposable Income:

| (Rs crores) | ||

| 1 | Rent | 100 |

| 2 | Net current transfers to rest of the world | 30 |

| 3 | Social security contributions by employers | 47 |

| 4 | Mixed income | 600 |

| 5 | Gross domestic capital formation | 140 |

| 6 | Royalty | 20 |

| 7 | Interest | 110 |

| 8 | Compensation of employees | 500 |

| 9 | Net domestic capital formation | 120 |

| 10 | Net factor income from abroad | (-)10 |

| 11 | Net indirect tax | 150 |

| 12 | Profit | 200 |

Giving reason explain how the following should be treated in the estimation of national income:

Payment of interest by a firm to a bank

Giving reason explain how the following should be treated in the estimation of national income:

Payment of interest by a bank to an individual

Giving reason explain how the following should be treated in the estimation of national income:

Payment of interest by an individual to a bank

Calculate the 'National Income' and 'Private Income' :

| (Rs in crores) | ||

| 1 | Rent | 200 |

| 2 | Net factor income to abroad | 10 |

| 3 | National debt interest | 15 |

| 4 | Wages and salaries | 700 |

| 5 | Current transfers from government | 10 |

| 6 | Undistributed profit | 20 |

| 7 | Corporation tax | 30 |

| 8 | Interest | 150 |

| 9 | Social security contributions by employers | 100 |

| 10 | Net domestic product accruing to government | 250 |

| 11 | Net current transfers to rest of the world | 5 |

| 12 | Dividends | 50 |

Calculate 'Net National Product at Market Price' and 'Personal Income'.

| (Rs crore) | ||

| (i) | Transfer payments by government | 7 |

| (ii) | Government final consumption expenditure | 50 |

| (iii) | Net imports | -10 |

| (iv) | Net domestic fixed capital formation | 60 |

| (v) | Private final consumption expenditure | 300 |

| (vi) | Private income | 280 |

| (vii) | Net factor income to abroad | -5 |

| (viii) | Closing stock | 8 |

| (ix) | Opening stock | 8 |

| (x) | Depreciation | 12 |

| (xi) | Corporate tax | 60 |

| Xii | Retained earnings of corporatio | 20 |

Giving reasons explain how should the following be treated in the estimation of national income:

Purchase of uniforms for nurses by a hospital

How should the following be treated in estimating the national income of a country? You must give a reason for your answer.

Taking care of aged parents

How should the following be treated while estimating national income? You must give the reason in support of your answer.

Addition to stocks during a year

How should the following be treated while estimating national income? You must give the reason in support of your answer.

Purchase of taxi by a taxi driver.

Investment made by the government is _____________ investment.(unplanned/gross/autonomous/induced)

Give reasons or Explain the following statements

Services of housewives are excluded from national income.

In an economy, S = −100 + 0.6 Y is the saving function, where S is Saving and Y is National Income. If investment expenditure is 1,100, calculate:

(1) Equilibrium level of National Income

(2) Consumption expenditure at equilibrium level of National Income.

C = 50 + 0.5 Y is the Consumption Function where C is consumption expenditure and Y is National Income and Investment expenditure is 2000 is an economy. Calculate

(i) Equilibrium level of National Income.

(ii) Consumption expenditure at equilibrium level of national income.

Distinguish between the following :

Output method and Income method of measuring national income.

Fill in the blank using proper alternative given in the bracket:

National income is ........ concept.

Define or explain the following concept.

Disposable income.

State whether the following statement is true or false.

Investment made by the government is autonomous investment.

Define or explain the following concept.

Induced Consumption expenditure.

(b) decreases

(c) becomes equal

(d) becomes zero

Write Explanatory answer. (Any Two )

What is national income. Explain how national income is mesured by output method

State whether the following statements are TRUE or FALSE:

Saving increases with increase in income.

Write explanatory notes.

Output method of measurement of national income.

Give reasons or explain the following statements:

The net national income is less than gross national income.

Distinguish between Illegal income and Transfer income.

Answer the following question:

What are the features of national income?

Answer the following question:

Explain the concept of Gross domestic product at market prices.

Answer in detail:

Explain the Output method of measuring National income.

Distinguish between:

Gross national product and Gross domestic product.

Distinguish between:

Output method of measuring national income and Income method of measuring national income.

Distinguish between:

National income at market prices and national income at factor cost

Write short note on:

Value added approach

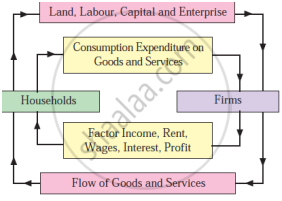

Write short note on:

Circular flow of national income

Define or explain the following concept:

Personal income

Define or explain the following concept:

Depreciation

Give reason or explain the following statement:

National income at factor cost includes subsidy.

Give reason or explain the following statement:

Old age pension is transfer income.

Give reason or explain the following statement:

Paid services are included in national income.

State whether the following statement is true or false.

Inclusion of value of intermediate goods leads to double counting.

State whether the following statement is true or false.

Services of housewives are included in national income.

Fill in the blank with appropriate alternatives given below

National income is the subject matter of _________ Economics.

Fill in the blank with appropriate alternatives given below

GDP (FC) = GDP (MP) – __________

Fill in the blank with appropriate alternatives given below

National income is __________ concept.

Define the following:

Income from property and entrepreneurship

Identify and explain the following concept:

Shobha collected data regarding the money value of all final goods and services produced in the country for the financial year 2018-2019.

Find the odd word

Concepts of national income -

Complete the following statement.

NNP is obtained by ______.

- Explain the concept of product (real flow) with the help of above diagram. (2m)

- Explain the concept of Money flow with the help of above diagram. (2m)

PASSAGE

Corona has slowed down the economy Lockdown imposed to contain the spread of Corona virus had resulted in closure of manufacturing and business activities. During this financial year, the economy is expected to move towards a contractionary phase rather than expansionary phase. This has been stated in the budget. This is the first paperless budget in the history of India. At the same time, it is the third post-independence budget to be presented at a time when the economy is shrinking. The budget shows a fiscal deficit of more than 5%.

The Union Finance Minister has presented a budget that seeks to accelerate the economy by balancing the impact of Corona on the economy on one hand and growing expectations of all sectors on the other. A significant increase in the allocation for Healthcare by 137% is a feature of this budget. In this budget, the expected revenue for the year 212-2022 is Rs. 34,35, 000crore and the expected expenditure is Rs. 35,83, 000 crore.

Attempts have been made to boost infrastructure, education, agricultural production, employment generation and industry, but the Income tax status quo has remained the same. The budget provides Rs.16.5 lakh crore for agricultural credit, Rs. 223,000 crore for health facilities, Rs. 3 lakh crore for Power Distribution Scheme, Rs. 15,700 crore for Small and Medium Enterprises and Rs. 20,000 crore for Government Bank Capital.

- What is the percentage increase in the provision for Healthcare? (1 mark)

- Mention the sectors that have been promoted in this budget. (1 mark)

- Express your personal opinion based on the above information regarding the budget ( 2 marks)

Per capita income is obtained by dividing the National income by the ______.

GNP =______ + Net factor income from abroad.

GNP =______ + Net factor income from abroad.

NNP stands for______.

The average income of the country is______.

What is the difference between NNP and NDP?

Write a short note on per capita income.

Explain briefly NNP at factor cost.

What is the solution to the problem of double counting in the estimation of national income?

Explain the meaning of non-market activities.

Nominal GNP is same as ____________.

Real GNP is same as ______.

GDPFC = ____________.

NNPFC =

Accounting of National Income at constant prices is known as ____________.

Which one is true?

NNPMP =?

Which of the following is correct?

Total national income divided by total population is known as:

Give economic term:

The volume of commodities and services turned out during a given period counted without duplication.

How should the following be treated in estimating National Income of a Country? Give valid reasons.

Profit earned by Foreign Banks in India.

How should the following be treated in estimating National Income of a Country? Give valid reasons.

Expenditure on upgradation of fixed asset by a firm.