Advertisements

Advertisements

Question

Find the odd word

Concepts of national income -

Options

GDP

NNP

LIC

GNP

Solution

LIC

RELATED QUESTIONS

National income

Explain the various methods of measuring national income.

In order to avoid double counting, value added approach is used.

Explain in detail ‘saving function’ with schedule and diagram.

Giving reason explain how should the following be treated in estimating national income:

i. Expenditure on fertilizers by a farmer.

ii. Purchase of tractor by a farmer.

Which of the following affects national income? (Choose the correct alternative)

(a) Goods and Service tax

(b) Corporation tax

(c) Subsidies

(d) None of the above

Explain the precautions that should be taken while estimating national income by expenditure method.

Calculate (a) National Income, and (b) Net National Disposable Income:

| (Rs In crores) | |

| (i) Compensation of employees | 2,000 |

| (ii) Rent | 400 |

| (iii) Profit | 900 |

| (iv) Dividend | 100 |

| (v) Interest | 500 |

| (vi) Mixed income of self- employed | 7,000 |

| (vii) Net factor income to abroad | 50 |

| (viii) Net export | 60 |

| (ix) Net indirect taxes | 300 |

| (x) Depreciation | 150 |

| (xi) Net current transfers to aboard | 30 |

Other things remaining unchanged, when in a country the price of foreign currency rises, national income is: (choose the correct alternative)

a. Likely to rise

b. Likely to fall

c. Likely to rise and fall both

d. Not affected

A government of India has recently launched 'Jan-Dhan Yojana' aimed at every household in the country to have at least one bank account. Explain how deposits made under the plan are going to affect the national income of the country.

Giving reason explain how should the following be treated in the estimation of national income:

Expenditure by a firm on payment of fees to a chartered accountant

Giving reason explain how should the following be treated in the estimation of national income:

Payment of corporate tax by a firm

Giving reason explain how should the following be treated in the estimation of national income:

Purchase of refrigerator by a firm for own use

Giving reason explain how the following should be treated in the estimation of national income:

Payment of interest by a firm to a bank

Giving reason explain how the following should be treated in the estimation of national income:

Payment of interest by a bank to an individual

Giving reasons explain how should the following be treated in the estimation of national income:

Purchase of machinery by a factory for own use

Giving reasons explain how should the following be treated in the estimation of national income:

Purchase of uniforms for nurses by a hospital

Calculate national income and gross national disposable income from the following:

| (Rs Arab) | ||

| 1 | Net current transfers to abroad | 5 |

| 2 | Government final consumption expenditure | 100 |

| 3 | Net indirect tax | 80 |

| 4 | Private final consumption expenditure | 300 |

| 5 | Consumption of fixed capital | 20 |

| 6 | Gross domestic fixed capital formation | 50 |

| 7 | Net imports | (-)10 |

| 8 | Closing stock | 25 |

| 9 | Opening stock | 25 |

| 10 | Net factor income to abroad | 10 |

How should the following be treated while estimating national income? You must give the reason in support of your answer.

Addition to stocks during a year

How should the following be treated while estimating national income? You must give the reason in support of your answer.

Purchase of taxi by a taxi driver.

Investment made by the government is _____________ investment.(unplanned/gross/autonomous/induced)

In an economy, S = −100 + 0.6 Y is the saving function, where S is Saving and Y is National Income. If investment expenditure is 1,100, calculate:

(1) Equilibrium level of National Income

(2) Consumption expenditure at equilibrium level of National Income.

Distinguish between the following :

Output method and Income method of measuring national income.

Define or explain the following concept.

Disposable income.

Define or explain the following concept.

Induced Consumption expenditure.

Fill in the blanks using proper alternatives given in the brackets

Personal Income - Direct Tax = ________________

(b) decreases

(c) becomes equal

(d) becomes zero

Write Explanatory answer. (Any Two )

What is national income. Explain how national income is mesured by output method

State whether the following statements are TRUE or FALSE:

Saving increases with increase in income.

Define of Explain the following concept.

Net earnings from foreign trade

Give reasons or explain the following statement:

The concept of national income has an important place in economic development.

Write explanatory notes.

Output method of measurement of national income.

Give reasons or explain the following statements:

The net national income is less than gross national income.

State whether the following statements are True or False with reason:

Ten years period is considered for measuring National Income.

Answer the following question:

What is double counting of national income?

Answer the following question:

What are the features of national income?

Answer in detail:

Explain the 'Final Good Approach' to avoid double counting of goods and services in the estimation of national income.

Distinguish between:

Gross national product and Gross domestic product.

Distinguish between:

Net national product and Net domestic product.

Distinguish between:

Output method of measuring national income and Income method of measuring national income.

Distinguish between:

Gross National Product and Net National Product

Write short note on:

Value added approach

Write short note on:

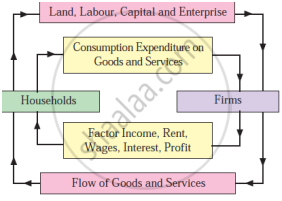

Circular flow of national income

Define or explain the following concept:

Final goods

Define or explain the following concept:

National income

Give reason or explain the following statement:

National income at factor cost includes subsidy.

Give reason or explain the following statement:

National income estimates are accurate in India.

Give reason or explain the following statement:

Old age pension is transfer income.

State whether the following statement is true or false.

Inclusion of value of intermediate goods leads to double counting.

State whether the following statement is true or false.

Financial year in India is leap year.

Match the following groups:

| Group A | Group B | ||

| 1) | Income method | a) | Personal income – direct taxes |

| 2) | Unemployment allowance | b) | Money value of goods and services |

| 3) | Disposable Income | c) | Factor cost method |

| 4) | National Income | d) | Personal income subsidy |

| 5) | NNP(MP) | e) | Transfer payment |

| f) | GNP(MP) - Depreciation | ||

| g) | Output method | ||

| h) | Transfer income | ||

Fill in the blank with appropriate alternatives given below

GDP (FC) = GDP (MP) – __________

Fill in the blank with appropriate alternatives given below

In India, the responsibility for the calculation of national income rests with _________.

Fill in the blank with appropriate alternatives given below

Paper purchased by a publisher is __________.

Distinguish between the following.

Personal income and Disposable income

Answer the following question.

Define the problem of double counting in the computation of national income. State any two approaches to correct the problem of double counting.

Assertion and Reasoning type question.

Assertion (A): In national income, value of only final goods and services produced in the economy are considered.

Reasoning (R): National income is always expressed in monetary terms.

Study the following table, figure, passage and answer the question given below it.

| Components of GNP for the year 2018 |

In crores |

| Consumption | 200 |

| Investment | 300 |

| Govt.Expenditure | 400 |

| Net export | - 100 |

| Net receipts | - 50 |

| Depreciation | 100 |

A. Complete the formula

GNP = C + `square` + G + (X - M) + `square` (1m)

B. Calculate Gross National Product & Net National Product from the above data. (3m)

- Explain the concept of product (real flow) with the help of above diagram. (2m)

- Explain the concept of Money flow with the help of above diagram. (2m)

Net National product at factor cost is also known as

Per capita income is obtained by dividing the National income by the ______.

GNP =______ + Net factor income from abroad.

NNP stands for______.

When net factor income from abroad is deducted from NNP, the net value is______.

The value of NNP at production point is called______.

The average income of the country is______.

Write the formula for calculating GNP.

What is the difference between NNP and NDP?

Trace the relationship between GNP and NNP.

Write a short note on per capita income.

Differentiate between personal and disposable income.

What is the solution to the problem of double counting in the estimation of national income?

Real GNP is same as ______.

Consider the following statements and identify the right ones.

- Personal income refers to the income of individuals of a country.

- The income at their disposal after paying direct taxes is called disposable income.

GDPFC = ____________.

NNPFC =

Accounting of National Income at constant prices is known as ____________.

GDP MP = Rs.1000 and subsidies = Rs.50, then GDP FC will be ______.

The market price of all final goods of a country in a year is known as:

GNPMP =?

NNPMP =?

Which of the following is correct?

If economic subsidies are added to and Indirect taxes are substracted from the national income at market prices, then it will be equal to ______.

Total national income divided by total population is known as:

Which of the following is not a component of domestic income?

Identify and explain the following concept.

Shobha collected data regarding the money value of all final goods and services produced in the country for the financial year 2019-20.

Give economic term:

The volume of commodities and services turned out during a given period counted without duplication.

How should the following be treated in estimating National Income of a Country? Give valid reasons.

Profit earned by Foreign Banks in India.

How should the following be treated in estimating National Income of a Country? Give valid reasons.

Expenditure on upgradation of fixed asset by a firm.

Explain the meaning of national income.