Advertisements

Advertisements

If the sum of first 7 terms of an A.P. is 49 and that of its first 17 terms is 289, find the sum of first n terms of the A.P.

Concept: Sum of First ‘n’ Terms of an Arithmetic Progressions

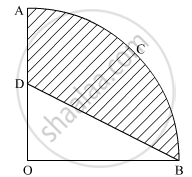

In the given figure, OACB is a quadrant of a circle with centre O and radius 3.5 cm. If OD = 2 cm, find the area of the shaded region.

Concept: Areas of Sector and Segment of a Circle

If the quadratic equation px2 − 2√5px + 15 = 0 has two equal roots then find the value of p.

Concept: Nature of Roots of a Quadratic Equation

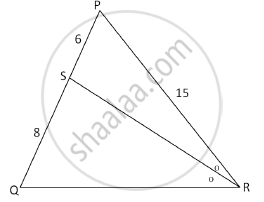

In the following figure, in ΔPQR, seg RS is the bisector of ∠PRQ. If PS = 6, SQ = 8, PR = 15, find QR.

Concept: Similarity of Triangles

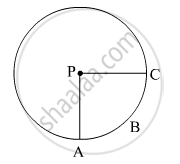

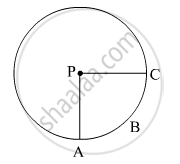

In the given figure, if A(P-ABC) = 154 cm2 radius of the circle is 14 cm, find

(1) `∠APC`

(2) l ( arc ABC) .

Concept: Circumference of a Circle

Prove the identity (sin θ + cos θ)(tan θ + cot θ) = sec θ + cosec θ.

Concept: Trigonometric Identities

Which of the following equations has 2 as a root?

Concept: Nature of Roots of a Quadratic Equation

In the given figure, if A(P-ABC) = 154 cm2 radius of the circle is 14 cm, find

(1) `∠APC`

(2) l ( arc ABC) .

Concept: Circumference of a Circle

Jaya borrowed Rs. 50,000 for 2 years. The rates of interest for two successive years are 12% and 15% respectively. She repays 33,000 at the end of the first year. Find the amount she must pay at the end of the second year to clear her debt.

Concept: Concept of Compound Interest > Compound Interest as a Repeated Simple Interest Computation with a Growing Principal

The catalogue price of a computer set is Rs. 42,000. The shopkeeper gives a discount of

10% on the listed price. He further gives an off-season discount of 5% on the discounted

price. However, sales tax at 8% is charged on the remaining price after the two successive

discounts. Find

1)the amount of sales tax a customer has to pay

2)the total price to be paid by the customer for the computer set.

Concept: Sales Tax, Value Added Tax, and Good and Services Tax

The printed price of an air conditioner is Rs. 45000/-. The wholesaler allows a discount of 10%

to the shopkeeper. The shopkeeper sells the article to the customer at a discount of 5% of the

marked price. Sales tax (under VAT) is charged at the rate of 12% at every stage. Find:

1) VAT paid by the shopkeeper to the government

2) The total amount paid by the customer inclusive of tax.

Concept: Sales Tax, Value Added Tax, and Good and Services Tax

Mr Lalit invested Rs. 5000 at a certain rate of interest, compounded annually for two years. At the end of the first year, it amounts to Rs. 5325. Calculate

1) The rate of interest

2) The amount at the end of the second year, to the nearest rupee.

Concept: Concept of Compound Interest > Use of Compound Interest in Computing Amount Over a Period of 2 Or 3-years

In what time will Rs. 1500 yield Rs. 496.50 as compound interest at 10% per annum compounded annually?

Concept: Concept of Compound Interest > Use of Compound Interest in Computing Amount Over a Period of 2 Or 3-years

A dealer buys an article at a discount of 30% from the wholesaler, the marked price being Rs. 6000. The dealer sells it to a shopkeeper at a discount of 10% on the marked price. If the rate of the VAT is 6%, find

1) The price paid by the shopkeeper including the tax.

2) The VAT paid by the dealer

Concept: Sales Tax, Value Added Tax, and Good and Services Tax

A shopkeeper bought an article for Rs. 3,450. He marks the price of the article 16% above the cost price. The rate of sales tax charged in the article is 10%

Find the:

1) market price of the article.

2) price paid by a customer who buys the article

Concept: Sales Tax, Value Added Tax, and Good and Services Tax

The present population of the town is 2,00,000. The population is increased by 10% in the first year and 15% in the second year. Find the population of the town at the end of two years.

Concept: Concept of Compound Interest > Use of Compound Interest in Computing Amount Over a Period of 2 Or 3-years

If a, b, c are in continued proportion, prove that (a + b + c) (a – b + c) = a2 + b2 + c2

Concept: Concept of Compound Interest > Compound Interest as a Repeated Simple Interest Computation with a Growing Principal

A wholesaler buys a TV from the manufacturer for Rs. 25,000. He marks the price of TV 20% above his cost price and sells it to a retailer at a 10% discount on the market price. If the rate of the VAT is 8%, find the :

1) Market price

2) Retailer’s cost price inclusive of tax.

3) VAT paid by the wholesaler.

Concept: Sales Tax, Value Added Tax, and Good and Services Tax

Ranbir borrows Rs. 20,000 at 12% per annum compound interest. If he repays Rs. 8400 at the end of the first year and Rs. 9680 at the end of the second year, find the amount of loan outstanding at the beginning of the third year.

Concept: Concept of Compound Interest > Use of Compound Interest in Computing Amount Over a Period of 2 Or 3-years

A shopkeeper bought a washing machine at a discount of 20% from a wholesaler, the printed price of the washing machine being Rs. 18,000. The shopkeeper sells it to a consumer at a discount of 10% on the printed price. If the rate of sales tax is 8%, find:

(i) the VAT paid by the shopkeeper.

(ii) the total amount that the consumer pays for the washing machine

Concept: Computation of Tax