Topics

Introduction to Micro and Macro Economics

Micro Economics

Macro Economics

Utility Analysis

- Utility

- Types of Utility

- Concepts of Utility

- Relationship Between Total Utility and Marginal Utility

- Law of Diminishing Marginal Utility

- Assumptions of Diminishing Marginal Utility

- Exceptions to the Law of Diminishing Marginal Utility

- Criticisms of the Diminishing Marginal Utility

- Significance of the Diminishing Marginal Utility

- Relationship Between Marginal Utility and Price

- Diminishing Marginal Utility

Demand Analysis

Elasticity of Demand

Supply Analysis

Forms of Market

Index Numbers

National Income

- Concept of National Income

- Features of National Income

- Circular Flow of National Income

- Different Concepts of National Income

- Methods of Measurement of National Income

- Output Method/Product Method

- Income Method

- Expenditure Method

- Difficulties in the Measurement of National Income

- Importance of National Income Analysis

Public Finance in India

Money Market and Capital Market in India

- Financial Market

- Money Market in India

- Structure of Money Market in India

- Organized Sector

- Reserve Bank of India (RBI)

- Commercial Banks

- Co-operative Banks

- Development Financial Institutions (DFIs)

- Discount and Finance House of India (DFHI)

- Unorganized Sector

- Role of Money Market in India

- Problems of the Indian Money Market

- Reforms Introduced in the Money Market

- Capital Market

- Structure of Capital Market in India

- Role of Capital Market in India

- Problems of the Capital Market

- Reforms Introduced in the Capital Market

Foreign Trade of India

- Internal Trade

- Foreign Trade of India

- Types of Foreign Trade

- Role of Foreign Trade

- Composition of India’s Foreign Trade

- Direction of India’s Foreign Trade

- Trends in India’s Foreign Trade since 2001

- Concept of Balance of Payments (BOP)

Introduction to Micro Economics

- Features of Micro Economics

- Analysis of Market Structure

- Importance of Micro Economics

- Micro Economics - Slicing Method

- Use of Marginalism Principle in Micro Economics

- Micro Economics - Price Theory

- Micro Economic - Price Determination

- Micro Economics - Working of a Free Market Economy

- Micro Economics - International Trade and Public Finance

- Basis of Welfare Economics

- Micro Economics - Useful to Government

- Assumption of Micro Economic Analysis

- Meaning of Micro and Macro Economics

Consumers Behavior

Analysis of Demand and Elasticity of Demand

Analysis of Supply

Types of Market and Price Determination Under Perfect Competition

- Market

- Forms of Market

- Market Forms - Duopoly

- Equilibrium Price

Factors of Production

- Factors of Production - Land

- Factors of Production: Labour

- Factors of Production: Capital

- Factors of Production - Feature of Capital

- Factors of Production - Organisation

Introduction to Macro Economics

- Features of Macro Economic

- Importance of Macro Economic

- Difference Between Mirco Economic and Macro Economic

- Allocation of Resource and Economic Variable

National Income

Determinants of Aggregates

- Total Demand for Good and Services

- Concept of Aggregate Demand and Aggregate Supply

- Consumption Demand

- Investment Demand

- Government Demand

- Foreign Demand

- Difference Betweeen Export and Import

- Effect of Population of Consumption Expediture

- Types of Investment Expenditure

- Micro Eco-Equilibrium

Money

- Meaning of Money

- Type of Money

- Primary Function

- Secondary Functions

- Standard of Deferred Payment

- Standard of Transfer Payment

- Money - Store of Value

- Concept of Barter Exchange

- Difficulties Involved in the Barter Exchange

- Monetary Payments

- Concept of Good Money

Commercial Bank

Central Bank

- Definition - Central Bank

- Central Bank Function - Banker's Bank

- Central Bank Function - Controller of Credit

- Monetary Function of Central Bank

- Non Monetary Function of Central Bank

- Method of Credit Control - Quantitative

- Repo Rate and Reverse Repo Rate

- Central Bank Function - Goverment Bank

Public Economics

- Introduction of Public Economics

- Features of Public Economics

- Meaning of Government Budget

- Objectives of Government Budget

- Features of Government Budget

- Public Economics - Budget (1 Year)(1 April to 31 March)

- Types of Budget

- Taxable Income

- Budgetary Accounting in India

- Budgetary Accounting - Consolidated , Contingency and Public Fund

- Components of Budget

- Factor Influencing Government Budget

Notes

Exceptions to the Law of Supply :

1) Supply of labour :

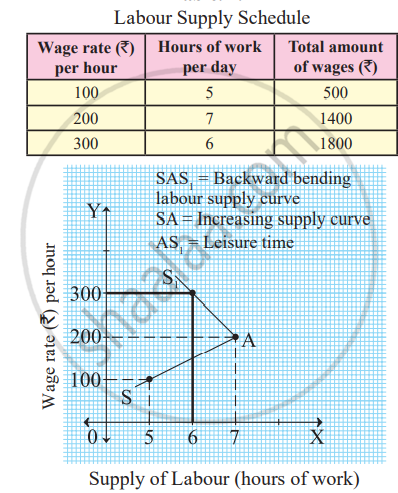

Labour supply is the total number of hours that workers to work at a given wage rate. It is represented graphically by a supply curve. In case of labour, as the wage rate rises the supply of labour (hours of work) would increase. So supply curve slopes upward. Supply of labour (hours of work) falls with a further rise in wage rate and supply curve of labour bends backward. This is because the worker would prefer leisure to work after receiving higher amount of wages. Thus, after a certain point when wage rate rises the supply of labour tends to fall. It can be explained with the help of a backward bending supply curve. The Table explains the backward bending supply curve of labour.

In the Table, supply of labour (hours of work) is shown on X axis and wage rate per hour is shown on the Y axis. The curve SAS represents backward bending supply curve of labour. Initially, when the wage rate is ₹100 per hour, the hours of work is 5. The total amount of wages received is ₹500. When wage rate rises from ₹100 to ₹ 200, hours of work will also rise from 5 hours to 7 hours and total amount of wages would also rise from ₹ 500 to ₹1400. At this point, labourer enjoys the highest amount i.e. ₹1400, and works for 7 hours. If wage rate rises further from ₹ 200 to ₹ 300, total amount of wages may rise, but the labourer will prefer leisure time and denies to work for extra hours. Thus, he is ready to work only for 6 hours. At the point A, the supply curve bends backward, which becomes an exception to the law of supply.

2) Agricultural goods :

The law of supply does not apply to agricultural goods as they are produced in a specific season and their production depends on weather conditions. Due to unfavourable changes in weather, if the agricultural production is low, their supply cannot be increased even at a higher

price.

3) Urgent need for cash :

If the seller is in urgent need for hard cash, he may sell his product at which may even be below the market price.

4) Perishable goods :

In case of perishable goods, the supplier would offer to sell more quantities at lower prices to avoid losses. For example, vegetables, eggs etc.

5) Rare goods :

The supply of rare goods cannot be increased or decreased according to its demand. Even if the price rises, supply remains unchanged. For example, rare paintings, old coins, antique goods etc