Topics

Introduction to Micro and Macro Economics

Micro Economics

Macro Economics

Utility Analysis

- Utility

- Types of Utility

- Concepts of Utility

- Relationship Between Total Utility and Marginal Utility

- Law of Diminishing Marginal Utility

- Assumptions of Diminishing Marginal Utility

- Exceptions to the Law of Diminishing Marginal Utility

- Criticisms of the Diminishing Marginal Utility

- Significance of the Diminishing Marginal Utility

- Relationship Between Marginal Utility and Price

- Diminishing Marginal Utility

Demand Analysis

Elasticity of Demand

Supply Analysis

Forms of Market

Index Numbers

National Income

- Concept of National Income

- Features of National Income

- Circular Flow of National Income

- Different Concepts of National Income

- Methods of Measurement of National Income

- Output Method/Product Method

- Income Method

- Expenditure Method

- Difficulties in the Measurement of National Income

- Importance of National Income Analysis

Public Finance in India

Money Market and Capital Market in India

- Financial Market

- Money Market in India

- Structure of Money Market in India

- Organized Sector

- Reserve Bank of India (RBI)

- Commercial Banks

- Co-operative Banks

- Development Financial Institutions (DFIs)

- Discount and Finance House of India (DFHI)

- Unorganized Sector

- Role of Money Market in India

- Problems of the Indian Money Market

- Reforms Introduced in the Money Market

- Capital Market

- Structure of Capital Market in India

- Role of Capital Market in India

- Problems of the Capital Market

- Reforms Introduced in the Capital Market

Foreign Trade of India

- Internal Trade

- Foreign Trade of India

- Types of Foreign Trade

- Role of Foreign Trade

- Composition of India’s Foreign Trade

- Direction of India’s Foreign Trade

- Trends in India’s Foreign Trade since 2001

- Concept of Balance of Payments (BOP)

Introduction to Micro Economics

- Features of Micro Economics

- Analysis of Market Structure

- Importance of Micro Economics

- Micro Economics - Slicing Method

- Use of Marginalism Principle in Micro Economics

- Micro Economics - Price Theory

- Micro Economic - Price Determination

- Micro Economics - Working of a Free Market Economy

- Micro Economics - International Trade and Public Finance

- Basis of Welfare Economics

- Micro Economics - Useful to Government

- Assumption of Micro Economic Analysis

- Meaning of Micro and Macro Economics

Consumers Behavior

Analysis of Demand and Elasticity of Demand

Analysis of Supply

Types of Market and Price Determination Under Perfect Competition

- Market

- Forms of Market

- Market Forms - Duopoly

- Equilibrium Price

Factors of Production

- Factors of Production - Land

- Factors of Production: Labour

- Factors of Production: Capital

- Factors of Production - Feature of Capital

- Factors of Production - Organisation

Introduction to Macro Economics

- Features of Macro Economic

- Importance of Macro Economic

- Difference Between Mirco Economic and Macro Economic

- Allocation of Resource and Economic Variable

National Income

Determinants of Aggregates

- Total Demand for Good and Services

- Concept of Aggregate Demand and Aggregate Supply

- Consumption Demand

- Investment Demand

- Government Demand

- Foreign Demand

- Difference Betweeen Export and Import

- Effect of Population of Consumption Expediture

- Types of Investment Expenditure

- Micro Eco-Equilibrium

Money

- Meaning of Money

- Type of Money

- Primary Function

- Secondary Functions

- Standard of Deferred Payment

- Standard of Transfer Payment

- Money - Store of Value

- Concept of Barter Exchange

- Difficulties Involved in the Barter Exchange

- Monetary Payments

- Concept of Good Money

Commercial Bank

Central Bank

- Definition - Central Bank

- Central Bank Function - Banker's Bank

- Central Bank Function - Controller of Credit

- Monetary Function of Central Bank

- Non Monetary Function of Central Bank

- Method of Credit Control - Quantitative

- Repo Rate and Reverse Repo Rate

- Central Bank Function - Goverment Bank

Public Economics

- Introduction of Public Economics

- Features of Public Economics

- Meaning of Government Budget

- Objectives of Government Budget

- Features of Government Budget

- Public Economics - Budget (1 Year)(1 April to 31 March)

- Types of Budget

- Taxable Income

- Budgetary Accounting in India

- Budgetary Accounting - Consolidated , Contingency and Public Fund

- Components of Budget

- Factor Influencing Government Budget

Notes

Methods of Measuring Price Elasticity of Demand :

1) Ratio or Percentage method :

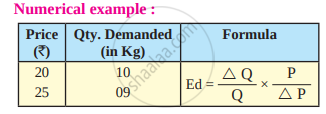

Ratio method is developed by Prof. Marshall. According to this method, elasticity of demand is measured by dividing the percentage change in demand by the percentage change in price. Percentage method is also known as Arithmetic method. Price elasticity is measured as :

`"Ed" = "Percentage change in Quantity demanded"/"Percentage change in Price"`

`"Ed"="%ΔQ"/"%ΔP"`

Mathematically, the above formula can be presented as under.

`"Ed"="ΔQ"/"Q"÷"ΔP"/"P"`

∴ `"Ed" = "ΔQ"/"Q"xx"P"/"ΔP"`

Q = Original quantity demanded

ΔQ = Difference between the new quantity and original quantity demanded.

P= Original price

ΔP= Difference between new price and original price

Original Price, P = 20, New price P = 25

ΔP = 5 (Difference between new and original price)

Original Quantity Demanded, Q = 10, New demand = 9

ΔQ = 1 (Difference between new and original quantity demanded)

`"Ed" = "ΔQ"/"Q"xx"P"/"ΔP"`

`"Ed"="1"/"10"xx"20"/"5"`

Ed= 0.4

Ed < 1

It means elasticity of demand is relatively inelastic.

2) Total Expenditure Method :

This method was developed by Prof. Marshall. In this method, total amount of expenditure before and after the price change is compared.

Here the total expenditure refers to the product of price and quantity demanded.

| Total expenditure = Price × Quantity demanded |

In this connection, Marshall has given the following propositions :

A) Relatively elastic demand (Ed >1) :

When with a given change in the price of a commodity total outlay increases, elasticity of demand is greater than one.

B) Unitary elastic demand (Ed = 1) :

When price falls or rises, total outlay does not change or remains constant, elasticity of demand is equal to one.

C) Relatively inelastic demand (Ed <1) :

When with a given change in price of a commodity total outlay decreases, elasticity of demand is less than one.

In case ‘A’, original price is ₹6 per unit and quantity 5 per unit demanded is 10 units. Therefore, total expenditure incurred is ₹60. When price falls to ₹ 5 quantitydemanded rises to 20 units, the total expenditure incurred is ₹100. In this case, total outlay is greater than original expenditure. Hence, at this stage, elasticity of demand is greater than one. (Ed >1) that is relatively elastic demand.

In case ‘B’, original price is ₹4 per unit and quantity demanded is 30 units. Therefore total expenditure is ₹120. When price falls to ₹‘3’ per unit quantity demanded rises to 40 units. Total expenditure incurred is ₹120. In this case total outlay is same (equal) to original expenditure. Hence, at this point, elasticity of demand is equal to one (Ed = 1) that is unitary elastic demand.

In case ‘C’, original price is ₹2 per unit and quantity demanded is 50 units. Therefore total expenditure is ₹100. When price falls to ₹1 per unit, quantity demand rises to 60 unit and total expenditure incurred is ₹60. In this case total outlay is less than original expenditure.

Hence, elasticity of demand is less than one (Ed <1) that is relatively inelastic demand.

3) Point method or Geometric Method :

Prof. Marshall has developed another method to measure elasticity of demand, which is known as point method or geometric method. The ratio method and total outlay methods are unable to measure elasticity of demand at a given point on the demand curve.

At any point on the demand curve, elasticity of demand is measured with the help of the following formula :

`"Point elasticity of demand (Ed)"="Lower segment of demand curve below a given point (L) "/"Upper segment of demand curve above a given point (U)"`

Demand curve may be either linear or non-linear as shown below :

A) Linear Demand Curve :

When the demand curve is linear i.e. a straight line, we extend the demand curve to meet the Y axis at ‘A’ and X axis at ‘B’. Price elasticity of demand at ‘X’ axis is zero and ‘Y’ axis is infinite. Elasticity of demand will be different at each point.

Let us assume that AB is a demand curve and its length is 8 cm. Point elasticity at various points on a linear demand curve can be measured as follows :

1) At point P, the point elasticity is measured as :

`"P"="PB"/"PA"="4"/"4"=1"`

Thus, at point P, demand is unitary elastic (ed = 1)

2) At point P1 , the point elasticity is measured as :

`"P"_"1"=("P"_1"B")/("P"_1"A")="2"/"6"=0.33"`

Thus, at point P1 , demand is relatively inelastic (ed < 1)

3) At point P2 , the point elasticity is measured as :

`"P"_"2"=("P"_2"B")/("P"_2"A")="6"/"2"=3`

Thus, at point P2 , demand is relatively elastic (ed > 1)

4) At point A, the point elasticity is ∞ (perfectly elastic demand)

5) At point B, the point elasticity is zero (perfectly inelastic demand.)

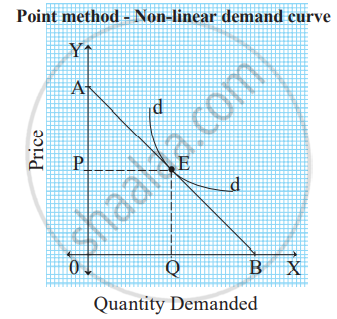

B) Non-linear demand curve :

When the demand curve is non-linear i.e. convex to origin, to measure price elasticity of demand we have to draw a tangent ‘AB’ touching the given point on the demand curve and extending it to meet ‘Y’ axis at point ‘A’ and ‘X’ axis at point ‘B'.

`"Ed" = "Lower segment of the tangent below a given point"/"Lower segment of the tangent below a given point"="L"/"U"`

If EB = EA (Ed = 1) - Unitary elastic demand

EB > EA (Ed >1) - Relatively elastic demand

EB < EA (Ed <1) - Relatively inelastic demand