Topics

Introduction to Micro and Macro Economics

Micro Economics

Macro Economics

Utility Analysis

- Utility

- Types of Utility

- Concepts of Utility

- Relationship Between Total Utility and Marginal Utility

- Law of Diminishing Marginal Utility

- Assumptions of Diminishing Marginal Utility

- Exceptions to the Law of Diminishing Marginal Utility

- Criticisms of the Diminishing Marginal Utility

- Significance of the Diminishing Marginal Utility

- Relationship Between Marginal Utility and Price

- Diminishing Marginal Utility

Demand Analysis

Elasticity of Demand

Supply Analysis

Forms of Market

Index Numbers

National Income

- Concept of National Income

- Features of National Income

- Circular Flow of National Income

- Different Concepts of National Income

- Methods of Measurement of National Income

- Output Method/Product Method

- Income Method

- Expenditure Method

- Difficulties in the Measurement of National Income

- Importance of National Income Analysis

Public Finance in India

Money Market and Capital Market in India

- Financial Market

- Money Market in India

- Structure of Money Market in India

- Organized Sector

- Reserve Bank of India (RBI)

- Commercial Banks

- Co-operative Banks

- Development Financial Institutions (DFIs)

- Discount and Finance House of India (DFHI)

- Unorganized Sector

- Role of Money Market in India

- Problems of the Indian Money Market

- Reforms Introduced in the Money Market

- Capital Market

- Structure of Capital Market in India

- Role of Capital Market in India

- Problems of the Capital Market

- Reforms Introduced in the Capital Market

Foreign Trade of India

- Internal Trade

- Foreign Trade of India

- Types of Foreign Trade

- Role of Foreign Trade

- Composition of India’s Foreign Trade

- Direction of India’s Foreign Trade

- Trends in India’s Foreign Trade since 2001

- Concept of Balance of Payments (BOP)

Introduction to Micro Economics

- Features of Micro Economics

- Analysis of Market Structure

- Importance of Micro Economics

- Micro Economics - Slicing Method

- Use of Marginalism Principle in Micro Economics

- Micro Economics - Price Theory

- Micro Economic - Price Determination

- Micro Economics - Working of a Free Market Economy

- Micro Economics - International Trade and Public Finance

- Basis of Welfare Economics

- Micro Economics - Useful to Government

- Assumption of Micro Economic Analysis

- Meaning of Micro and Macro Economics

Consumers Behavior

Analysis of Demand and Elasticity of Demand

Analysis of Supply

Types of Market and Price Determination Under Perfect Competition

- Market

- Forms of Market

- Market Forms - Duopoly

- Equilibrium Price

Factors of Production

- Factors of Production - Land

- Factors of Production: Labour

- Factors of Production: Capital

- Factors of Production - Feature of Capital

- Factors of Production - Organisation

Introduction to Macro Economics

- Features of Macro Economic

- Importance of Macro Economic

- Difference Between Mirco Economic and Macro Economic

- Allocation of Resource and Economic Variable

National Income

Determinants of Aggregates

- Total Demand for Good and Services

- Concept of Aggregate Demand and Aggregate Supply

- Consumption Demand

- Investment Demand

- Government Demand

- Foreign Demand

- Difference Betweeen Export and Import

- Effect of Population of Consumption Expediture

- Types of Investment Expenditure

- Micro Eco-Equilibrium

Money

- Meaning of Money

- Type of Money

- Primary Function

- Secondary Functions

- Standard of Deferred Payment

- Standard of Transfer Payment

- Money - Store of Value

- Concept of Barter Exchange

- Difficulties Involved in the Barter Exchange

- Monetary Payments

- Concept of Good Money

Commercial Bank

Central Bank

- Definition - Central Bank

- Central Bank Function - Banker's Bank

- Central Bank Function - Controller of Credit

- Monetary Function of Central Bank

- Non Monetary Function of Central Bank

- Method of Credit Control - Quantitative

- Repo Rate and Reverse Repo Rate

- Central Bank Function - Goverment Bank

Public Economics

- Introduction of Public Economics

- Features of Public Economics

- Meaning of Government Budget

- Objectives of Government Budget

- Features of Government Budget

- Public Economics - Budget (1 Year)(1 April to 31 March)

- Types of Budget

- Taxable Income

- Budgetary Accounting in India

- Budgetary Accounting - Consolidated , Contingency and Public Fund

- Components of Budget

- Factor Influencing Government Budget

Notes

Output Method :

This method of measuring national income is also known as product method or inventory

method. This method approaches national income from the output side. According to this method, the economy is divided into different sectors, such as agriculture, mining, manufacturing, small enterprises, commerce, transport, communication and other services. The output or product method is followed either by valuing all the final goods and services, produced during a year, at their market price or by adding up all the values at each higher stage of production, until these products are turned into final products.

While using this method utmost care must be taken to avoid multiple or double counting.

To avoid double counting this method suggests two alternative approaches for the measurement of GNP:

i) Final Goods Approach / The Final Product Approach :

Final goods are those goods which are ready for final consumption. According to this approach, value of all final goods and services produced in primary, secondary and tertiary sector are included and the value of all intermediate transactions are ignored. Intermediate goods are involved in the process of producing final goods, that is, the final flow of output purchased by consumers. Hence, the value of final output includes the value of intermediate products.

For example, the price of bread includes, the cost of wheat, making of flour, etc., wheat and flour are both intermediate goods. Their values are paid up during the process of production. In the final product i.e. bread, the values of intermediate goods are already included.

Thus, a separate accounting of the values of intermediate goods, along with the accounting of the value of final product, would mean double counting. To avoid this, the value of only the final product or goods must be computed.

ii) Value Added Approach / The Value Added Method :

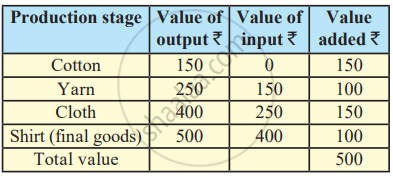

In order to avoid double counting value added approach is used. According to this approach, the value added at each stage of the production process is included. The difference between the value of final outputs and inputs, at each stage of production is called the value added. Thus, GNP is obtained as the sum total of the values added by all the different, stages of

the production process, till the final output is reached in the hands of consumers, to meet

the final demand. This can be illustrated with the help of the following table.

Value added at each stage is calculated by deducting the value of inputs from the value of

output produced. The sum total added at different stages make GNP. In the above table the value of final good (Shirt) is ₹500. The sum total of value added at each stage of production is also ₹500. Thus the total value added is equal to the value of final goods. (150 + 100 + 150 + 100 = 500)

Precautions :

1) To avoid double counting, only the value of final goods and services must be taken into

account.

2) Goods used for self consumption by farmers should be estimated by a guess work. Imputed value of goods produced for self consumption is included in national income.

3) Indirect taxes included in the market prices are to be deducted and subsidies given by

the government to certain products should be added for accurate estimation of national

income.

4) While evaluating output, changes in the price level between different years must be

taken into account.

5) Value of exports should be added and value of imports should be deducted.

6) Depreciation of capital assets should be deducted.

7) Sale and purchase of second hand goods should be ignored as it is not a part of

current production.

Output method is widely used in the underdeveloped countries. However, it is less reliable because of the margin of error. In India, this method is applied to agriculture, mining and manufacturers, including handicrafts. But it is not applied for transport, commerce and communication sectors in India.

Related QuestionsVIEW ALL [4]

Study the following table and answer the questions:

| Production Stage | Value of Input (₹) | Value added (₹) | Value of Output (₹) |

| Sugar cane (Farmer) | 0 | 25 | 25 |

| Sugar (Manufacturer) | `square` | 15 | 40 |

| Retailer | 40 | `square` | 50 |

| Total Value | `square` |

Questions:

- How much is the value of input for a manufacturer?

- How much value is added by the retailer?

- How much is the final value of the product?

- Which method of measuring national income is represented by the above table?